does florida have real estate taxes

Available to all residents and amounting to a maximum of 50000 off the assessed value of the property. The biggest tax advantage to being a Florida resident as opposed to a non-resident who has a home in the state is Floridas real property taxes.

Florida Property Taxes Mls Campus

The average property tax rate in Florida is 083.

. In Florida homeowners do not have to pay property taxes to the state government. Heres an example of how much capital gains tax you might. The amount is based on the assessed value of your home and vary.

Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021. Real estate property taxes are collected every year and can be paid online only 2021 taxes until May 31 2022. The first step in the Florida property tax process is property appraisal which is the act of placing a value on a piece of real estate.

Property taxes or real estate taxes are paid by a real estate owner to county or local tax authorities. Get Record Information From 2021 About Any County Property. Cannot increase by more than 3 of the previous years assessment or the Consumer Price Index whichever is less.

Counties in Florida collect an average of 097 of a propertys assesed fair. Florida does not have an inheritance tax so. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

By Jon Alper Updated July 22 2022. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. Instead it is the local governments that collect property taxes which serve as their main source of funding.

Federal Estate Tax. In the year after the property receives the homestead. These taxes are based on an assessed value.

The average effective property tax rate in Florida is 102 though the exact rate varies depending on which. Note that the total amount you can deduct for state and local real estate costs is 10000 for married couples filing jointly and 5000 for those filing singly or separately. Florida property taxes are slightly lower than the US.

The strength of Floridas low tax burden comes from its lack of an income tax making them one of seven such states in the US. An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. Ad Searching Up-To-Date Property Records By County Just Got Easier.

According to section 193155 FS property appraisers must assess homestead property at just value as of January 1 of each tax year. Floridas average real property tax rate is 098 which is slightly lower than the US. Its called the 2 out of 5 year rule.

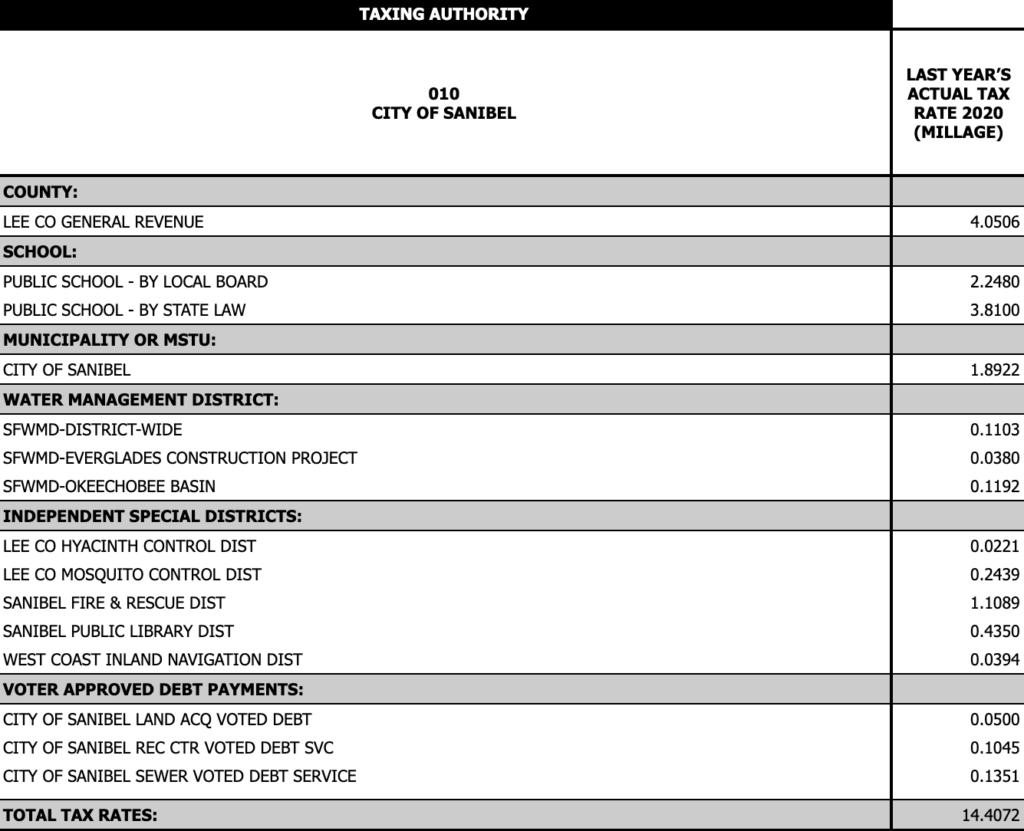

If payment is received by May 31 2022 it must be made in. There are also special tax districts such as schools and water management districts that have. Every county in Florida has a property.

Each county sets its own tax rate. What this means is that. The average Florida homeowner pays 1752 each year in real property taxes although.

The state constitution prohibits such a tax though Floridians. Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is.

Legal Advice To Avoid Taxes On Inheritance

Florida Property Taxes Explained

Florida S 50 Largest Cities And Towns Ranked For Local Taxes Kiplinger

Handling Property Taxes At A Closing In Florida What Do I Need To Know

Florida Real Estate Taxes You Should Know Florida Independent

Property Taxes Brevard County Tax Collector

How To Lower My Property Taxes In Florida Learn More

How High Are Property Taxes In Your State Tax Foundation

Property Taxes By State 2016 Eye On Housing

Where Are The Lowest Property Taxes In Florida Mansion Global

Study Finds Real Estate Taxes Hit Poor Hardest Not Necessarily Used For Assumed Purposes The University Of Kansas

Florida Property Taxes Explained

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Florida Tax Rates Rankings Florida State Taxes Tax Foundation

Comparison Of Real Estate Taxes For 2021 Live South Florida Realty Inc

Florida Property Tax Appeals Challenge And Reduce Your Tax Liability

Are There Any States With No Property Tax In 2022 Free Investor Guide